19th May 2021 | 4th Edition

1. There’s an “Airbnb” for allotments!

Demand for allotments surged during lockdown with the National Allotment Society reporting an uplift of more than 300% last year. But green-fingered enthusiasts now have another option, thanks to the launch of an Airbnb-style rental platform for gardens.

AllotMe allows people across the UK to rent their spare outdoor space to those seeking somewhere to grow their own fruit, veg and plants.

2. Wayfair’s $112 billion plan to take over your entire home

Wayfair founders, Steve Conine and Niraj Shah launched RacksandStands.com in 2002, a site dedicated to selling speaker stands. Their products sold so well that they replicated the model and launched more and more product-specific sites - ending up with around 250 sites in total! Eventually, they rolled them all into one and called it Wayfair. Fast forward to 2020 and Wayfair did a whopping $14.1 billion in business in furniture and home goods.

This article explores how Wayfair works, why they employ more than 3000 engineers and data scientists, and what’s next for the company.

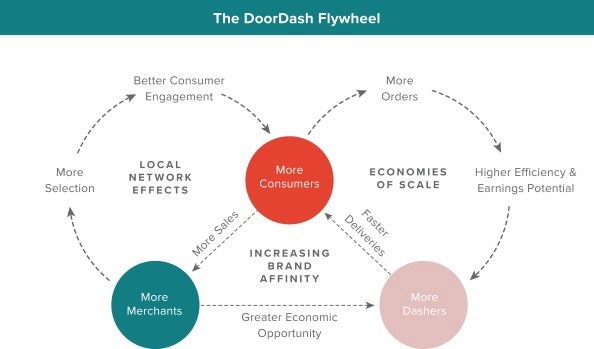

3. How DoorDash built the most incredible go-to-market playbook ever

In the long-form Medium article, investor Lars Kamp digs sifts through the DoorDash S-1 to find out how they built an economic moat by combining execution with data and intelligence.

His three key takeaways are:

You don’t need to be first-to-market. It’s much more important to find a segment with an unmet need that you can serve with a better product, expanding the market.

Find a repeatable model. That allowed DoorDash to raise more money than anyone of their competitors, and use that funding to outrun everybody else.

Build an economic moat with data. DoorDash generated a huge proprietary data set that they used to make their operations more efficient, generate more marketplace transaction volume, and create economic lift for all marketplace participants

4: Handshake, a job search platform for college students, valued at $1.5 Billion after new funding round

In 2014, Garrett Lord and his friends-turned-cofounders—Ben Christensen, 28, and Scott Ringwelski, 28—launched Handshake, a network to help millions of students from all backgrounds get hired and launch their careers, no connections or experience required.

Last week, the San Francisco-based startup announced that it had secured $80 million in Series E funding from investors including Lightspeed Venture Partners and Spark Capital, among others. With total funding of $235.5 million, CEO Lord says Handshake’s valuation is more than $1.5 billion.

Got any feedback? Get in touch with me at marketplaceminute@substack.com

You can also find me on Twitter @marketplaceux

Finally, if you’re interested in working with me, check out my website: https://www.fimacd.com